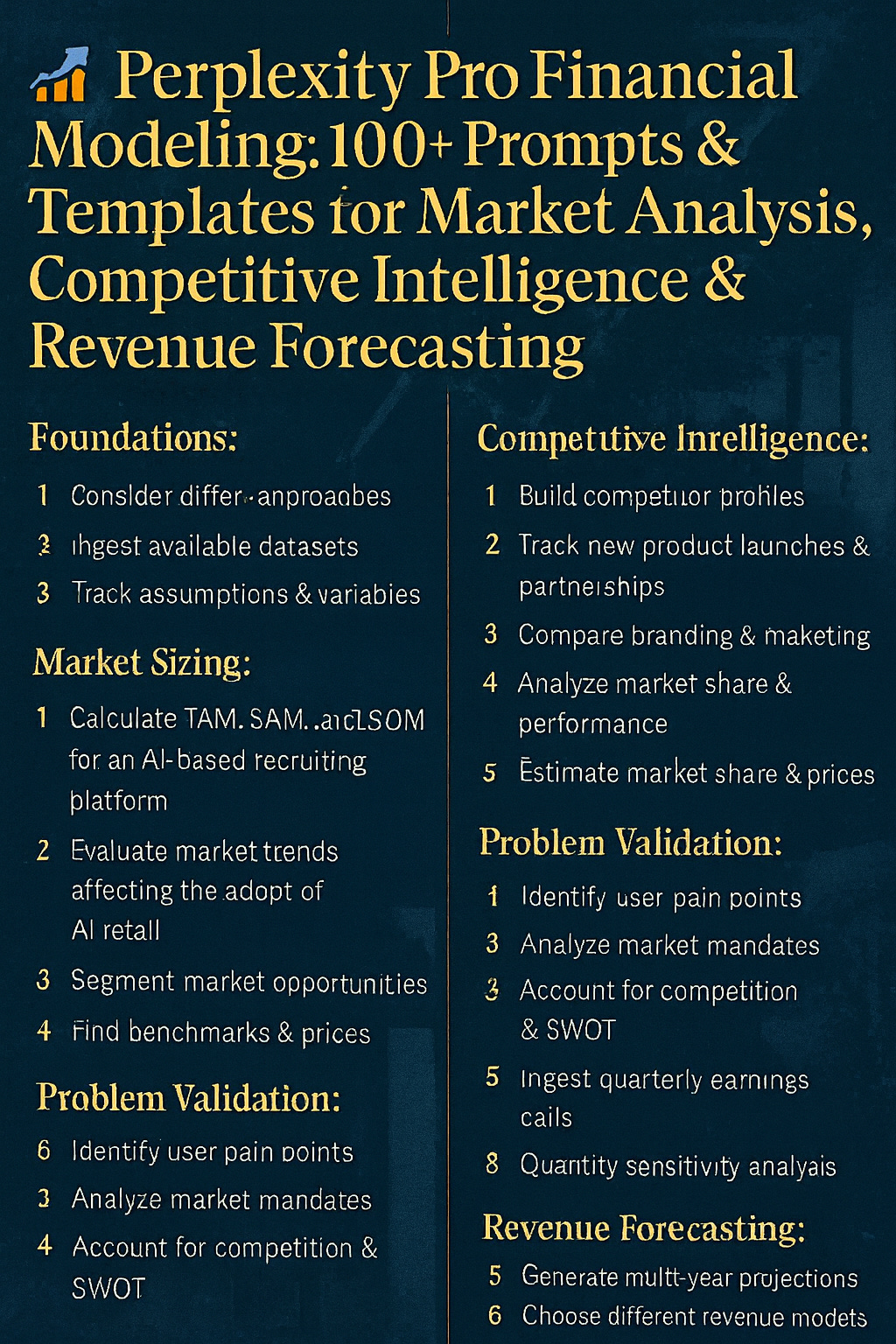

📊 Perplexity Pro Financial Modeling: 100+ Prompts & Templates for Market Analysis, Competitive Intelligence & Revenue Forecasting

Why Traditional Financial Tools Are Sabotaging Your Analysis 🎯

Here’s what your typical “productive” financial research session actually looks like:

Open Bloomberg Terminal ($24,000/year) → Export data to Excel → Search for industry reports → Read through 50+ pages of PDFs → Cross-reference competitor filings → Build models manually → Still unsure if you caught everything important → Repeat for every analysis.

The dirty secret: Legacy financial platforms make billions keeping you clicking through interfaces. Your fragmented workflow is their business model.

But here’s what changed: Perplexity Pro transforms a simple prompt into comprehensive market analysis, competitive intelligence reports, and revenue forecasting models—all with live data, interactive charts, and working calculations. In about 10 minutes.

What Perplexity Pro Actually Is (And Why It Matters for Finance) 💡

After 8 months of daily use, here’s my take: Perplexity Pro isn’t just another AI chatbot. It’s a financial research-first AI that combines web search with large language models to deliver what Bloomberg, FactSet, and traditional tools should have built years ago.

The fundamental difference:

Traditional tools: You navigate → They display data → You do all the analytical work

Perplexity Pro: You ask → It researches → It synthesizes → Analysis delivered with citations

What Makes Perplexity Different

Unlike Google, which forces you to sift through countless results, Perplexity’s answer engine:

Actively searches the web and cites sources in real time

Connects directly to real-time market data, earnings reports, and SEC filings

Synthesizes information from multiple sources into concise answers

Allows natural follow-up questions without losing context

Provides inline citations so you can verify every claim

The Finance section specifically provides structured insights without toggling between multiple tabs—displaying live stock quotes, earnings summaries, peer comparisons, and SEC filings with contextual summaries and source links.

Perplexity Pro Pricing: Built for Financial Professionals 💰

Understanding the investment is crucial for finance teams:

Professional Plan ($20/month or $200/year)

300+ Pro Searches Daily – Perfect for intensive analysis

Access to multiple latest AI models

Reasoning models

Unlimited file uploads for financial documents

$5/month in API credits included

Ad-free experience with priority processing

Max Plan ($200/month or $2,000/year)

Unlimited access to latest AI models

Unlimited Labs usage for dashboard creation

Early access to new features

Priority support for critical analysis

Enterprise Pro ($40/month per seat)

Team collaboration features

Advanced security and compliance

Centralized billing and admin controls

SOC 2 Type II compliance

For most financial analysts, the Pro plan delivers exceptional ROI—replacing multiple expensive subscriptions while providing superior analytical capabilities.

ROI Calculation: 95%+ cost savings vs. traditional stack ($57,000/year → $240-2,400/year)

Perplexity Finance: Core Capabilities 🚀

1. Real-Time Market Analysis

Ask about drivers behind price moves or commodity swings and get concise, cited answers. The platform excels at pulling live stock quotes, earnings summaries, peer comparisons, and SEC filings—providing a clean snapshot of any company with price, P/E ratio, market cap, dividend yield, and contextual summaries.

2. Earnings Summarization

Feed a 30-page earnings call into Perplexity and receive bullet-point highlights in seconds. Users can ask follow-up questions like “What caused revenue to decline?” and receive context-aware answers that cite credible sources.

3. Sector-Specific Research

Whether forecasting semiconductor demand or analyzing biotech TAM, Perplexity pulls recent news, whitepapers, and industry reports without paywalls. The platform balances speed and accuracy—excelling at quick snapshots while acknowledging that deep quantitative analysis requires complementary tools.

4. Follow-Up Threads

Ask follow-up questions without repeating context—Perplexity remembers and adapts throughout the conversation, building on previous queries naturally.

5. Data Integrations

Leverage Financial Modeling Prep (FMP) API data, Google Finance, and Yahoo Finance for metrics. Pair Perplexity’s narrative output with Excel or FMP for raw numbers.

100+ Prompts for Market Analysis, Competitive Intelligence & Revenue Forecasting

Foundations: Assumptions, Definitions, Sources (12 Prompts)

1. Business Terms Glossary

“Define all business terms used in this analysis (ARPU, churn, net revenue retention, CAC payback, contribution margin). Return a glossary with formulas.”

2. Data Source Validation

“List credible data sources for [industry] demand, pricing, and adoption (government, trade groups, top research firms). Rank by reliability.”

3. Missing Data Checklist

“Given this data room (paste bullets/links), map what’s missing to build a defensible forecast. Output a ‘Missing Data’ checklist.”

4. Variable Sheet Creation

“Create a clean variable sheet for a revenue model. Include units, typical ranges, and sensitivity bounds for each variable.”

5. Scenario Assumptions

“Draft assumptions for base/bull/bear scenarios with rationale and sources.”

6. Data Dictionary

“Convert messy CSV headers into modeling-friendly names + a data dictionary.”

7. Assumption Tracking Template

“Build a template to log every assumption, the source, last updated date, and owner.”

8. Circular Reference Detection

“Flag any circular references in my current logic (paste formulas/code). Suggest fixes.”

9. Peer Set Selection

“Suggest peer sets (public + private) that match our business model and stage. Explain inclusion criteria.”

10. Audit Trail Format

“Create an audit trail format for every chart (source, query, extraction method, timestamp).”

11. Unit Economics Validation

“Validate my unit economics assumptions (CAC, LTV, payback period) against [industry] benchmarks. Flag any outliers.”

12. Assumption Sensitivity Matrix

“Build a sensitivity matrix showing how changes in key assumptions (growth rate, margin, discount rate) impact valuation. Rank assumptions by materiality.”

Market Sizing & Macro Analysis (Top-Down) (35 Prompts)

Sector Overview & Macro Analysis

13. Comprehensive Market Overview

“Provide a current overview of the [industry] sector. Include market size, CAGR, top players and recent regulatory changes. Present the data in bullet points with citations.”

14. Growth Drivers & Headwinds

“Identify the primary growth drivers and risks facing the [industry] sector in the next 3 years. Summarize macroeconomic, technological and regulatory factors.”

15. Porter’s Five Forces Analysis

“Conduct a Porter’s Five Forces analysis for the [industry] sector, highlighting the bargaining power of suppliers and buyers, threat of substitutes, threat of new entrants and competitive rivalry.”

16. PESTEL Analysis

“Perform a PESTEL analysis for [industry] in the United States. List key political, economic, social, technological, environmental and legal factors.”

17. Cross-Sector Comparison

“Compare the performance of [industry A] vs [industry B] over the last 12 months using revenue growth, profitability and valuation multiples.”

18. Economic Impact Assessment

“Explain how rising interest rates are affecting [industry] companies’ margins and capital expenditures. Include examples from recent earnings calls.”

19. Geographic Trends

“Describe regional differences in [industry] growth across North America, Europe and Asia. Include market size and growth forecasts for each region.”

20. Emerging Markets Identification

“Identify emerging markets within [industry] that are poised for rapid growth. Provide supporting statistics and recent investment activity.”

21. Technology Disruption Analysis

“Analyze how [technology] is disrupting the [industry] sector. Discuss current use cases, adoption rate and future outlook.”

22. Consumer Sentiment Tracking

“Summarize recent consumer sentiment trends affecting [industry]. Include data from surveys, social media and spending patterns.”

Keep reading with a 7-day free trial

Subscribe to The Product Channel By Sid Saladi to keep reading this post and get 7 days of free access to the full post archives.